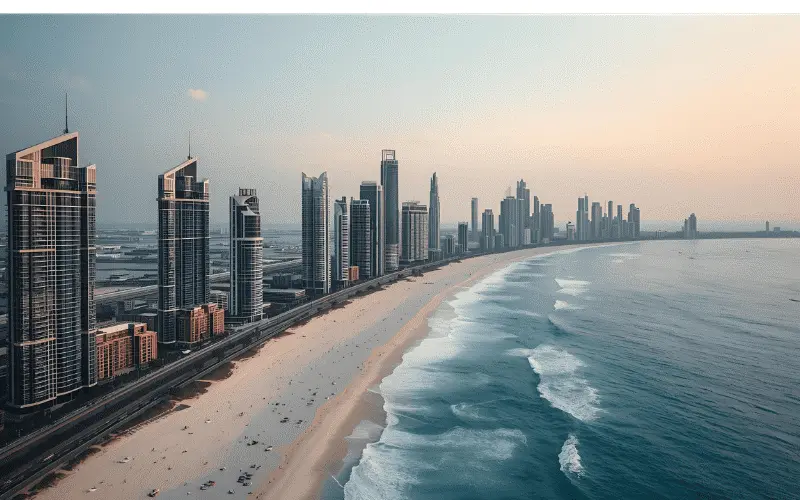

Dubai’s real estate market in 2026 continues to captivate beginners worldwide, blending luxury appeal with accessible entry points for smart investments. With steady growth fueled by tourism and innovation, it’s an ideal time to explore opportunities like those offered by UInvestGroup, a trusted partner for seamless property purchases and strategic investments in Dubai’s thriving landscape. Whether you’re aiming for passive income or capital appreciation, this guide demystifies the process, helping you launch your journey confidently and profitably.

Why Dubai Real Estate Appeals to First-Time Investors in 2026

Dubai stands out for its investor-friendly ecosystem, where tax-free gains and high yields make it a beginner’s paradise. The city’s GDP is set to expand by 4-5%, supporting a market where rental returns average 6-8%, and affordable options can deliver up to 12% in emerging areas. For newcomers, the low barriers—starting at AED 300,000—and Golden Visa perks (for AED 2M+ investments) add layers of security and lifestyle benefits, all without the complexities of traditional markets.

The Role of Trusted Advisors in Your Journey

Partnering with experienced firms early on can transform overwhelm into opportunity. Groups like UInvestGroup specialize in guiding beginners through market insights, personalized portfolios, and hassle-free transactions, ensuring your first investment aligns perfectly with your goals.

Emerging Trends Shaping Beginner Opportunities

Sustainability and smart tech dominate 2026 launches, with eco-friendly properties boosting values by 5-7%. Off-plan deals, comprising 60% of sales, offer 10-20% discounts, making high-potential assets more attainable.

Real-world example: A novice investor from Europe secured a AED 650,000 off-plan unit in JVC via expert guidance; by mid-2026, it generated 8% yields while appreciating 10%.

A Simple Step-by-Step Roadmap for Beginners

Follow these streamlined steps to go from curious to committed, with tips tailored for remote or in-person execution.

Step 1: Build Your Knowledge Base

Dive into freehold zones (e.g., Dubai Marina, JVC) where non-residents own outright. Use DLD resources and apps like Bayut for trends.

- Beginner Tip: Spend 2-3 weeks on free webinars from platforms like UInvestGroup to grasp yields and risks.

- Common Mistake to Dodge: Overlooking RERA regulations—always confirm agent credentials.

Step 2: Clarify Goals and Set a Realistic Budget

Decide on yield-driven rentals or growth-focused buys. Factor in 6-8% fees beyond the price.

Beginner Tip: Target AED 500,000-1M for a 1-bedroom yielding 7-9%; tools on Property Finder simulate returns.

Common Mistake to Dodge: Ignoring exchange rates—Dubai’s AED-USD peg offers stability for internationals.

Step 3: Select Property Type and Prime Location

Apartments suit starters for ease; villas add space but higher costs.

-

Jumeirah Village Circle (JVC): AED 700K-1.2M, 7-8% yields, vibrant communities.

-

Dubai South: AED 600K-1M, 7-8% potential, Expo-driven growth.

-

International City: AED 380K average, 8-9% yields, ultra-affordable.

Beginner Tip: Prioritize metro-adjacent spots; virtual tours make scouting effortless.

Common Mistake to Dodge: Trend-chasing—emphasize amenities and tenant demand.

Step 4: Build Your Support Network

Secure a RERA-licensed agent (2% fee), lawyer (AED 5K-10K), and if needed, a financier for 50% LTV mortgages at 3-4%.

Beginner Tip: Platforms like UInvestGroup connect you with vetted pros, streamlining remote deals.

Common Mistake to Dodge: Skipping title checks—DLD verifies ownership cleanly.

Step 5: Negotiate and Lock In Your Purchase

Tender 10% deposit post-offer; the SPA safeguards your interests with escrow.

Beginner Tip: Haggle 5-10% on off-plan; power of attorney enables virtual closings.

Common Mistake to Dodge: Hastiness—scrutinize delay or quality clauses.

Step 6: Finalize Transfer and Ownership

Settle the balance at handover; 4% DLD fee secures your title deed swiftly.

Beginner Tip: For AED 1M deals, prep AED 20K-50K in fees.

Common Mistake to Dodge: Missing developer NOCs—plan ahead.

Step 7: Optimize and Scale Your Asset

List for rent through agents (10% cut) or Dubizzle; monitor with Ejari.

Beginner Tip: Furnish for 20% quicker lets; target 80%+ occupancy.

Common Mistake to Dodge: Service fees (AED 10-15/sq ft)—budget annually.

Spotlight on Versatile Options: Villas for Growing Families

As you gain confidence, consider scaling to family-oriented properties. A 2 bedroom villa for sale in Dubai in areas like Arabian Ranches starts at AED 3M, offering private spaces, community perks, and 5-6% yields from steady rentals—ideal for blending lifestyle with returns.

Beginner-Friendly Neighborhood Spotlight for 2026

|

Neighborhood |

Avg Price (AED) |

Yield (%) |

Appreciation (%) |

Best For |

Airport Distance |

|---|---|---|---|---|---|

|

JVC |

700K-1.2M |

7-8 | 8-10 |

Families |

30 min |

|

Dubai South |

600K-1M |

7-8 | 10-12 |

Growth |

20 min |

|

International City |

380K |

8-9 | 6-8 |

Budget |

15 min |

|

Dubai Silicon Oasis |

900K-1.3M |

6-8 | 7-9 |

Tech Pros |

20 min |

|

Al Furjan |

570K-1.5M |

7.5 | 8-10 |

New Families |

25 min |

These picks balance accessibility, returns, and convenience.

Budgeting Essentials: Costs and Funding Insights

-

Initial Outlays: 4% DLD, 2% agent, 0.25% mortgage reg + AED 290.

-

Recurring: AED 10-15/sq ft service, AED 500/month utilities.

-

Funding Paths: Non-resident mortgages up to 50% LTV at 3-4%; 20-50% down.

-

AED 1M Sample Total: AED 60K-80K in closing expenses.

Insight: AED 2M+ triggers Golden Visa, enhancing loan options.

Pro Tips to Accelerate Your Success

-

Scale Gradually: Kick off with a studio for quick wins.

-

Spread Risks: Blend off-plan growth with ready income plays.

-

Embrace Digital: VR viewings and AI analytics cut guesswork.

-

Connect Locally: Expats on forums share gold-standard advice.

-

Go Green: Certified eco-properties lift values 5%.

-

Plan Exits: 3-5 year holds optimize gains.

-

Lean on Experts: RERA-vetted teams prevent pitfalls.

Success story: An Indian beginner via UInvestGroup snagged a AED 800K JVC off-plan in 2025; by 2026, it hit 8% yields and 12% uplift.

Quick Answers to Common Beginner Queries

1. Foreigner-Friendly Ownership?

Yes, full freehold in zones like JVC—zero hurdles.

2. Entry-Level Minimum?

AED 300K studios; AED 2M for visa perks.

3. Timeline for Deals?

Off-plan: 4-8 weeks; ready: 2-4 weeks.

4. Mortgage Access?

50% LTV at 3-4% for outsiders via UAE banks.

5. Top Starter Type?

JVC apartments: 7-8% yields, simple management.

6. 2026 Yield Outlook?

6-8% norm; 8-12% in value plays.

7. Remote Oversight?

Managers at 10%; Ejari tracks everything.

8. Newbie Hazards?

Dips rare; escrow shields delays.

9. Tax Realities?

None locally; home-country reporting if applicable.

10. Off-Plan or Ready?

Off-plan saves cash; ready cashes in now.

Wrapping Up: Your Gateway to Dubai’s Property Goldmine

In 2026, Dubai property welcomes beginners with open arms—high yields, easy access, and expert support like UInvestGroup pave the way. Follow this blueprint, team up wisely, and begin modestly to unlock enduring riches. Forecasts show 5-10% uplift ahead, so seize the moment to buy property in Dubai and craft your success story. Reach out to a RERA pro, run the math, and step into your prosperous future.